market news summary

According to Russian news agency TASS, Deputy Prime Minister Alexander Novak stated on Thursday that Russian companies will decide for themselves whether to decrease oil production or exports in August. However, Russia’s primary objective remains reducing global market supplies. Russia has announced a plan to reduce oil exports by 500,000 barrels per day in August, but the specifics of how they will achieve this have not been clarified. Moreover, there are conflicting indications regarding whether Russia will reduce its own oil production by the same extent.

European stocks closed higher on Thursday, led by technology stocks, as hopes grew for the end of the US Federal Reserve’s ongoing monetary tightening cycle after the pandemic, thanks to a slowdown in US inflation.

The European Stoxx 600 index concluded the day with a 0.6% increase, marking its fifth consecutive session of gains. This winning streak represents the index’s longest period of sustained growth in almost three months.

Dollar Index (USDX)

The US dollar came under further pressure and declined on Thursday, July 13th, as market participants viewed the unexpected slowdown in inflation in the United States as a sign that the interest rate hike cycle may be nearing its end by the end of this month.

The euro is poised to register gains for the sixth consecutive day, rising 0.3% in the latest trading session to $1.115 after reaching its earlier high at $1.11580.

Pivot point: 99.70

| Resistance level | Support level |

| 99.99 | 99.10 |

| 100.55 | 98.80 |

| 100.85 | 98.25 |

Spot Gold (XAUUSD)

Gold prices rose on Thursday, July 13th, to their highest level in nearly a month, supported by a decline in the US dollar following US inflation data that bolstered hopes that the Federal Reserve would soon pause its monetary tightening policy.

Spot gold rose 0.2% to $1,959.94 per ounce, reaching its highest level since June 16th, while US gold futures increased by 0.1% to $1,964.40.

Pivot point: 1958

| Resistance level | Support level |

| 1965 | 1953 |

| 1969 | 1947 |

| 1976 | 1942 |

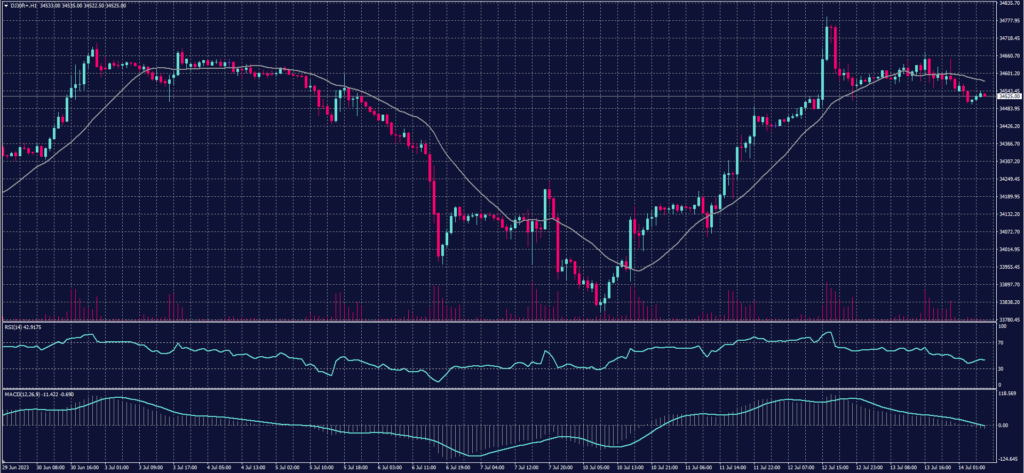

Dow Jones Index (DJ30ft – US30)

US indices closed with strong gains on Thursday after Producer Price Index (PPI) data raised hopes among investors of a potential pause in the Federal Reserve’s tightening policy. The PPI rose by 0.1% on a yearly basis in June, marking the smallest increase since August 2020.

The Dow Jones Industrial Average increased by 0.14%, or approximately 48 points, achieving its fourth consecutive daily gain. Similarly, the S&P 500 index rose by around 0.8%, closing above the 4,500-point level for the first time in 15 months.

Pivot point: 34585

| Resistance level | Support level |

| 34635 | 34505 |

| 34785 | 34372 |

| 34900 | 34155 |

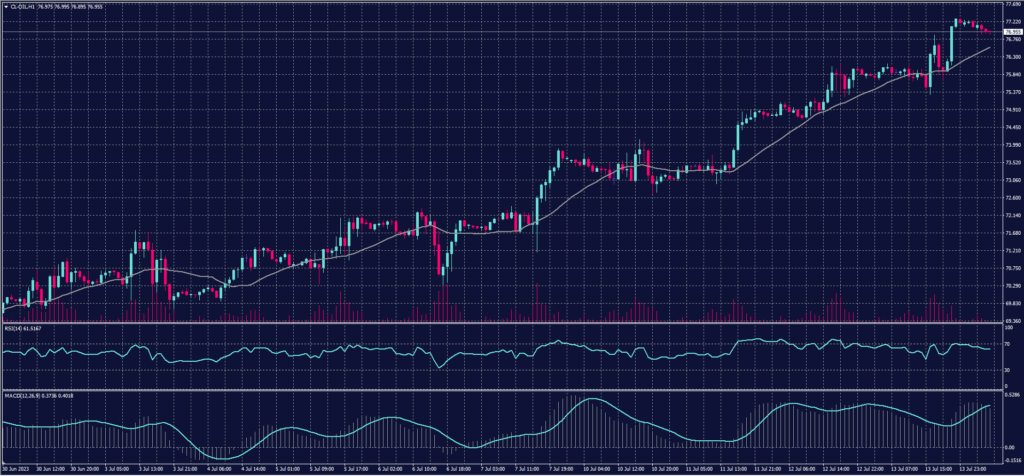

US Crude Oil (USOUSD)

Oil prices rose over 1% on Thursday, reaching their highest levels in nearly three months, following US inflation data indicating that interest rates in the world’s largest economy are approaching their peak.

Brent crude futures increased by $1.25, or 1.6%, to $81.36 per barrel. The session’s highest price reached $81.57, marking the highest level since April 25th.

Similarly, US West Texas Intermediate (WTI) crude futures rose by $1.14, or 1.5%, to $76.89 per barrel. The session’s highest price reached $77.13, the highest level since April 26th.

Pivot point: 76.60

| Resistance level | Support level |

| 77.90 | 75.90 |

| 78.60 | 74.60 |

| 79.90 | 73.85 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.