Goldman Sachs expects a significant decline in the US inflation rate in 2023, but it will remain above the Fed’s target of 2%. The US bank said in a note yesterday that the core personal consumption expenditures index, which is the preferred measure of inflation for the Fed, may decline from levels of 5.1% recorded in September to 2.9% by the end of next year.

European shares rose at the close of Monday’s trading session, amid assessment of recent inflation data in the US and economic data in Europe.

Oil prices fell by about 3% when settling trading of Monday, after the release of the monthly OPEC report, and amid following up on the latest developments of the Corona pandemic in China.

Dollar Index (USDX)

The US dollar is trying to stabilize above 106.50 levels after increasing expectations of a significant decline in the US inflation rate next year 2023.

The dollar index continues to decline to its important resistance levels at 106.70 and indicates the that the decline might possibly continue. On the hourly chart, the technical indicators are showing signs of a bullish swing from the current levels, but the moving averages are indicating the opposite. In the meantime, the daily chart confirms the readings of the moving averages and shows the possibility of a further decline towards 105.15.

Pivot Point: 106.70

| Resistance Level | Support Level |

| 107.10 | 106.30 |

| 107.54 | 105.90 |

| 108.35 | 105.00 |

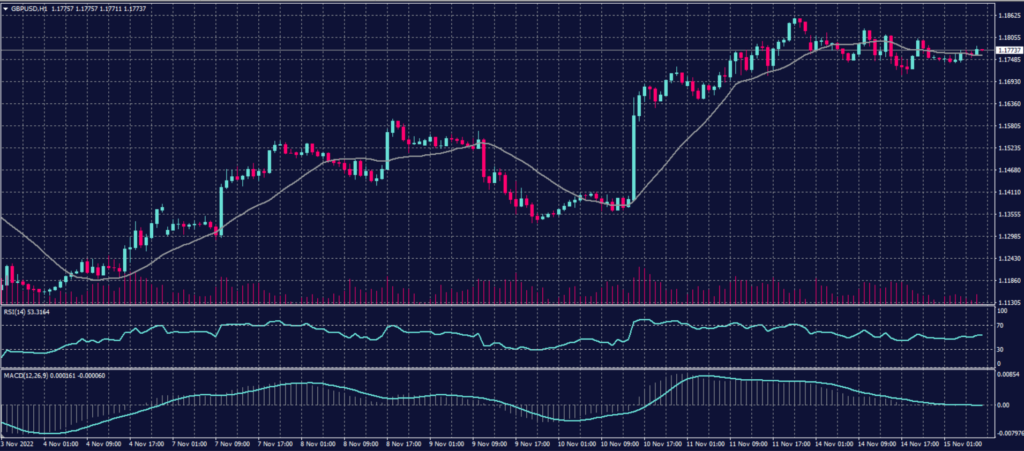

British Pound (GBPUSD)

After a turmoil in the UK markets over the past month, UK assets are starting to stabilize with Rishi Sunak taking over as Prime Minister.

Perhaps the most prominent reason behind the chaos that occurred in Britain is the mini budget from former Chancellor of the Exchequer Kwarteng. As for this week, Jeremy Hunt, the new finance minister, is expected to announce on Thursday 17th November the new financial plan for Britain, and it is estimated that Hunt will raise taxes in his budget to reform public finances.

The Pound is trying to stabilize above its pivot point at 1.1760 with conflicting technical readings.

Pivot Point: 1.1765

| Resistance Level | Support Level |

| 1.1815 | 1.1695 |

| 1.1880 | 1.1645 |

| 1.1900 | 1.1525 |

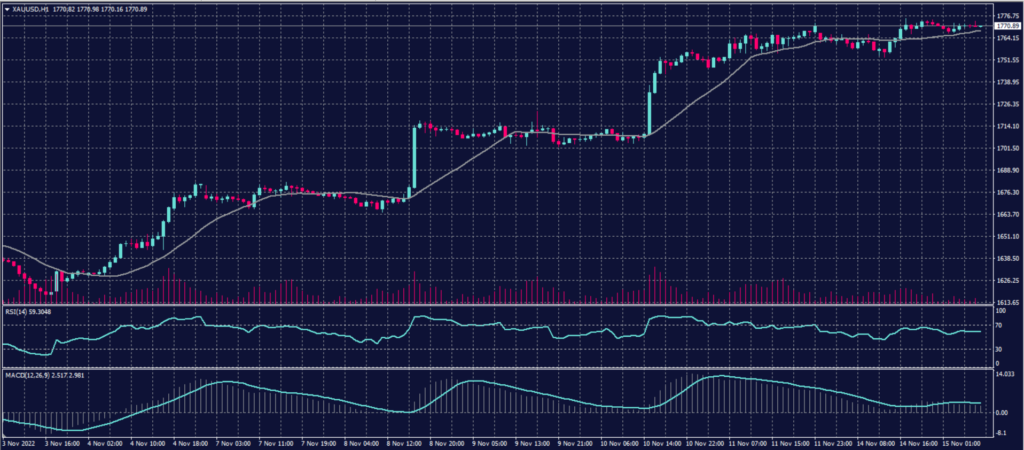

Spot Gold (XAUUSD)

Gold prices achieved the highest settlement price since mid-August with trading settled on Monday, November 14th.

Upon settlement, the price of gold increased by 0.4%, or about $7.50, to $1,776.90 an ounce, the highest settlement price for the most active contract since mid-August.

Attention turned to the G-20 summit held in Bali, where the US President and his Chinese counterpart met in person for the first time in 3 years.

US President “Joe Biden” said in statements on the sidelines of the meeting, “We spent a lot of time together when we were both Vice Presidents and how wonderful it is to meet you,” adding in statements to reporters that he is committed to keeping the lines of communication open at the personal and governmental levels.

Technically, gold is trading above its resistance at 1770 with a buying divergence that may unload at current prices.

Pivot Point: 1,765

| Resistance Level | Support level |

| 1,775 | 1,757 |

| 1,780 | 1,745 |

| 1,788 | 1,735 |

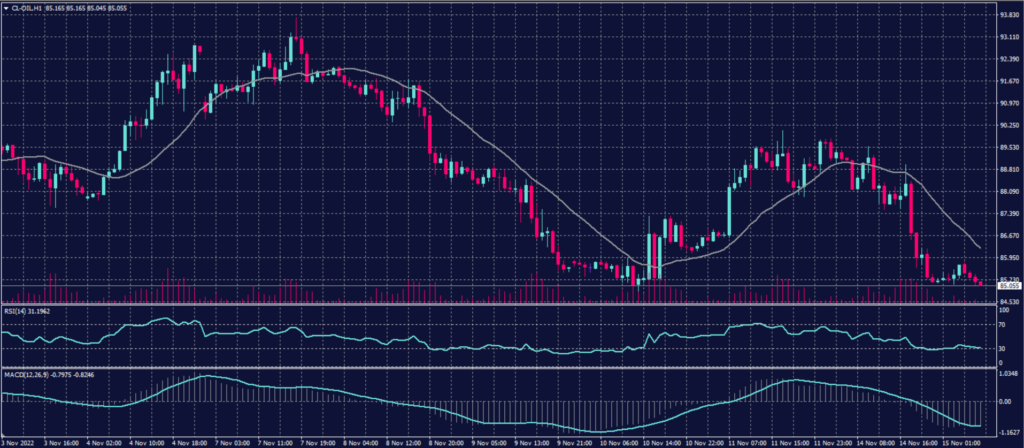

US Crude (USOUSD)

Oil prices fell by about 3% when settling trading on Monday, after the release of the monthly OPEC report, and amid following up on the latest developments of the Corona pandemic in China.

In its monthly report, the OPEC lowered the forecast for global oil demand growth by 100,000 barrels per day in both 2022 and 2023.

Upon settlement, Brent crude futures fell by about 3% to $93.14 a barrel, and US Nymex crude contracts fell by 3.5 percent to $85.87 a barrel.

Pivot Point: 86.70

| Support Level | Resistance Level |

| 84.10 | 88.30 |

| 83.60 | 90.10 |

| 82.00 | 91.00 |