market news summary

In May, inflation in the Eurozone slowed down to 6.1% in the preliminary reading, compared to 7% recorded in April, marking the lowest level since February 2022. Economists surveyed by Reuters had expected a May reading of 6.3%.

Core inflation, excluding energy and food, also decreased more than expected to 5.3% from 5.6%.

European stocks rose at the end of yesterday’s Thursday trading session as the data on inflation decline sparked a debate about the need to raise interest rates beyond this month. It also boosted hopes that the United States would avoid defaulting on its debt, lifting investor sentiment. The Euro Stoxx 600 index closed up 0.8% after hitting its lowest level in two months in the previous session.

Late on Wednesday, the US House of Representatives approved the debt ceiling bill to suspend the $31.4 trillion debt limit, which now goes to the Senate. The Senate must pass the measure before Monday when the government’s funds are set to run out.

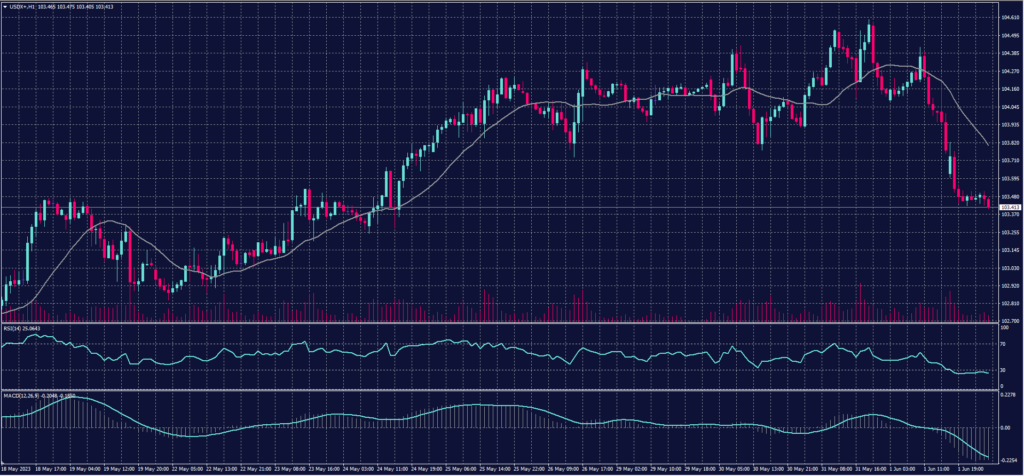

Dollar Index (USDX)

The US dollar retreated from its two-month high on Thursday, June 1, as investors scaled back their expectations of the Federal Reserve raising interest rates this month. However, the US dollar received some support after the House of Representatives voted to suspend the debt ceiling.

The dollar index notably declined after initial jobless claims and employment data were released. The index is currently trading at 103.40 points, experiencing a drop of up to 0.35%.

Pivot Point: 103.75

| Resistance level | Support level |

| 104.10 | 103.10 |

| 104.75 | 102.75 |

| 105.10 | 102.10 |

Spot Gold (XAUUSD)

Gold prices rose to their highest level in over a week during yesterday’s trading session as the US dollar weakened following US economic data that sparked speculation that the Federal Reserve would keep interest rates unchanged at this month’s meeting.

At the end of Thursday’s session, August gold futures rose by 0.7% or approximately $13.40 to settle at $1,995.50 per ounce.

Pivot Point: 1971

| Resistance level | Support level |

| 1989 | 1959 |

| 2001 | 1941 |

| 2019 | 1929 |

Dow Jones Index (DJ30ft – US30)

In Thursday’s session, the Dow Jones Industrial Average rose by approximately 0.5%, or 153 points, closing above the 33,000 level.

The S&P 500 index also increased by around 1%, achieving its highest closing in 9 months. This was supported by a more than 5% rise in Nvidia stocks in the first trading sessions of June. Additionally, the Nasdaq Composite index rose by about 1.3%, marking its highest closing since mid-August 2022.

Pivot Point: 33025

| Resistance level | Support level |

| 33325 | 32850 |

| 33500 | 32555 |

| 33795 | 32375 |

US Crude (USOUSD)

Oil prices rose on Thursday by the largest amount in two weeks ahead of the OPEC+ meeting on Sunday. The approval of a bill by the US House of Representatives to suspend the debt ceiling helped offset the impact of rising inventories in the country.

West Texas Intermediate (WTI) crude oil increased by $2.01, or 3%, to $70.10 per barrel at settlement, marking the largest daily gains since May 5. Brent crude futures reached $74.28 per barrel at settlement, rising by $1.68, or 2.3%. These were the largest daily gains since May 17.

Pivot Point: 69.55

| Support level | Resistance level |

| 68.05 | 71.60 |

| 66.00 | 73.10 |

| 64.55 | 75.15 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.