Market News Summary

On Thursday, the American company Apple announced strong quarterly results for the fourth quarter of 2023, exceeding market expectations. This was primarily due to robust iPhone sales and the positive performance of the services sector. However, the company reported a decline in sales in all divisions except for iPhones, including a slowdown in iPad and Mac computer sales. Apple recorded a 16% growth in its online services unit, which balanced out the weakness in sales of its other devices.

European stocks rose more than one percent yesterday, led by real estate and technology stocks sensitive to interest rates. This was driven by increasing optimism that central banks have finished tightening credit after the United States, Britain, and Norway kept interest rates unchanged this week. The Stoxx 600 index closed 1.6% higher, nearing a new high in two weeks.

Dollar Index (USDX)

The markets are awaiting job, unemployment, and wage data today, with analysts expecting the economy to add 188,000 jobs, a decrease from the 336,000 jobs added in September. The unemployment rate is expected to remain steady at 3.8%.

The dollar index is attempting to stabilize after its decline following the U.S. interest rate hold and hints about easing monetary tightening from the Federal Reserve. The index is currently trading near its pivotal point at $106.

Pivot Point: 105.95

| Resistance level | Support level |

| 106.35 | 105.65 |

| 106.65 | 105.30 |

| 107.00 | 104.95 |

Spot Gold (XAUUSD)

Following the release of yesterday’s jobless claims report, which showed an increase above expectations with the number of applicants reaching 217,000 for unemployment benefits in the past week, the price of gold surged, approaching the $2,000 level in futures contracts.

Gold is currently trading around the pivotal point, awaiting further economic data today.

Pivot Point: 1984

| Resistance level | Support level |

| 1991 | 1978 |

| 1997 | 1972 |

| 2003 | 1966 |

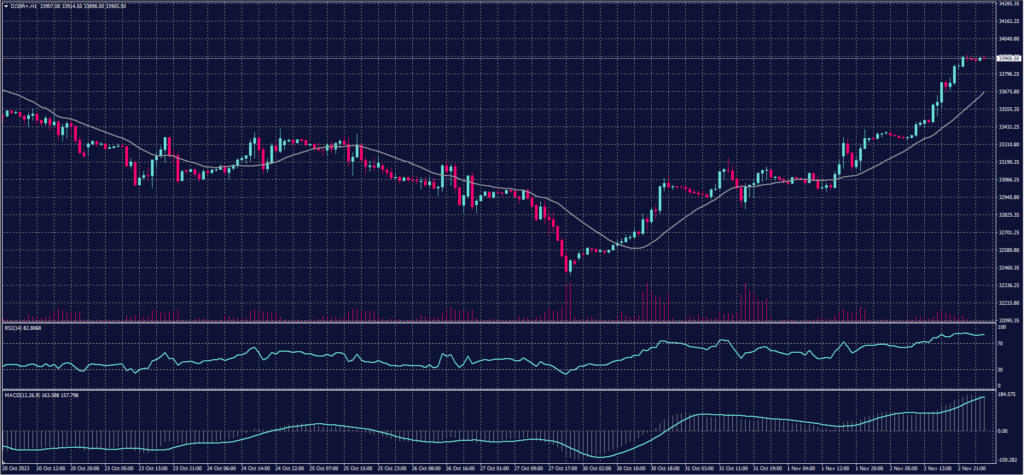

Dow Jones Index (DJ30ft – US30)

The U.S. markets closed with robust collective gains on Thursday, bolstered by a decline in long-term Treasury bond yields due to optimism that the Federal Reserve may have reached the end of its interest rate hike campaign following Jerome Powell’s statements the day before. Risk appetite increased during the session, supported by quarterly financial results, as data showed that 81% of companies reporting had earnings higher than expectations.

The Dow Jones jumped 1.7%, equivalent to a 564-point increase, marking its fourth consecutive daily gain and achieving the highest daily gains in five months. The Nasdaq Composite rose for the fifth straight session, recording its highest daily gains in three months. The S&P 500 rose by 1.9%, achieving its highest daily gains in six months, supported by collective sectoral gains. Additionally, the index closed above the 200-day moving average for the first time since October 24th.

Pivot Point: 33725

| Resistance level | Support level |

| 34115 | 33520 |

| 34320 | 33130 |

| 34710 | 32925 |

US Crude Oil (USOUSD)

Oil prices rose more than two dollars per barrel on Thursday, ending a three-day losing streak, as risk appetite returned to financial markets after the Federal Reserve kept interest rates unchanged.

Brent crude futures surged by $2.22, or 2.6%, to reach $86.85 per barrel at the close, while West Texas Intermediate (WTI) crude futures, the U.S. benchmark, increased by $2.23, or 2.8%, to reach $82.67 per barrel at the close.

Pivot Point: 81.85

| Resistance level | Support level |

| 83.45 | 80.85 |

| 84.40 | 79.25 |

| 86.00 | 78.25 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.