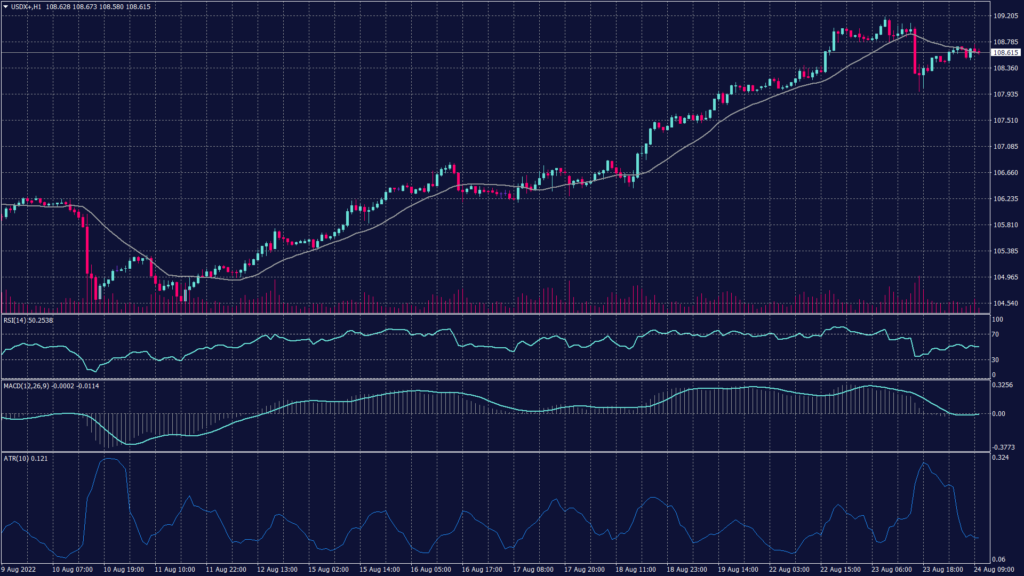

U.S. Dollar Index (USDX)

The U.S. dollar steadied above 108.70 this morning, as investors await to hear from the Federal Reserve and pondered whether weak U.S. data may slow the pace of rate hikes.

All eyes now turn to Jackson Hole, Wyoming, where the Federal Reserve holds its annual symposium and Fed Chair Jerome Powell is due to speak on Friday. The U.S. dollar index rose 0.12% to 108.68 on Wednesday, and July’s two-decade high of 109.29.

Technically, the index remains holding the momentum towards the new high finding support above 108.50 at the time of writing the report. Meanwhile, Fibonacci retracement shows the support too far from the current levels on the hourly chart at 107.40. However, the price action shows support at 108.80 and 108.40. Also, technical indicators show a possibility of a drop due to the emotional resistance the index is facing at 109.20.

PIVOT POINT: 108.80

| SUPPORT | RESISTANCE |

| 108.50 | 109.20 |

| 108.40 | 109.80 |

| 108.00 | 110.10 |

Euro (EURUSD)

Disappointing U.S. services and manufacturing data plunge in new home sales last month stopped the greenback from penetrating a 20-year high against the common currency. However, the euro remained under pressure below parity levels at $0.99485 during the Asian session.

The European currency remains weak despite the early bounce from 0.9902 to 0.9949 and finding resistance at 0.9935. Technical indicators show a possibility for the continuation of the downtrend regardless of the RSI neutral level at the hourly chart. Meanwhile, the daily chart confirms the decline and remains to pressure the current levels towards 0.9850.

PIVOT POINT: 0.9930

| SUPPORT | RESISTANCE |

| 0.9900 | 0.9950 |

| 0.9880 | 0.9990 |

| 0.9850 | 1.0010 |

Spot Gold (XAUUSD)

Gold prices held recent gains on Wednesday as the dollar retreated slightly on weak economic data, with the focus now turning to commentary from the Federal Reserve on the path of interest rates.

Focus is now on Fed Chair Jerome Powell’s address to the Jackson Hole Symposium on Friday, which is expected to provide more cues on monetary policy. Traders broadly expect the Chair to maintain his hawkish stance, which will herald more sharp interest rate hikes this year. Gold futures fell 0.1% to $1,759.25 an ounce, while spot gold fell 0.1% to $1,746.33 an ounce.

Spot gold remains negative on both the daily and hourly time frames, but it shows a horizontal trend on the hourly chart. Meanwhile, the daily chart shows a sharper and clearer downtrend targeting levels near $1,700 per ounce.

PIVOT POINT: 1,748

| SUPPORT | RESISTANCE |

| 1,723 | 1,758 |

| 1,715 | 1,770 |

| 1,706 | 1,764 |

West Texas Crude (USOUSD)

Oil prices fell on Wednesday, taking a breather from a nearly 4% surge the previous day, on receding fears of an imminent output cut by the Organization of the Petroleum Exporting Countries and allies, a group known as OPEC+.

Underlining tight supply, U.S. crude stockpiles fell by about 5.6 million barrels for the week ended Aug. 19., according to market sources citing American Petroleum Institute figures on Tuesday, against analysts’ estimate of a drop by 900,000 barrels in a Reuters poll. However, Brent crude fell 0.4% to $99.82 a barrel, while WTI crude was down 0.29% at $93.47 a barrel.

WTI rebounded from the support at 93.20 reaching above $94.50 per barrel and rising. However, the overall trend remains negative on the daily time frame unless prices broke above $96.20 per barrel which is the neckline of the double bottom on the daily chart.

PIVOT POINT: 95.00

| SUPPORT | RESISTANCE |

| 94.25 | 96.20 |

| 93.50 | 97.40 |

| 92.75 | 100.10 |